How to Draw a Trend Line for stock Trading

How to Draw a Trend Line for stock Trading

Welcome to Stock Market Section of Mahakal Trading. I this blogpost Mahakal Trading explain you How to Draw a Trend Line for Stock Trading. Read this blogpost of Mahakal Trading Before you Draw a Trend Line. Mahakal Trading think this post is very helpful for beginner, for working professional or a business person. After reading full article, If you realize that Mahakal Trading give you somthing different which is helpful for you then please follow Mahakal Trading Blog for such type of stock trading tips.

How to Draw a Trend Line for stock Trading

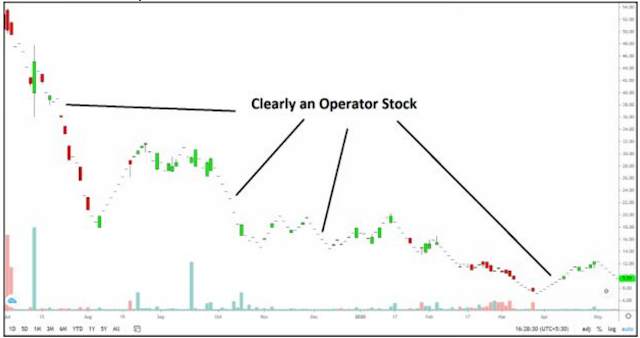

Before you draw a trend line on any chart, ensure it’s not an

operator stock, and price action is smooth. In both cases, it’s better to

avoid them as there is a high probability of hitting your stop-loss.

Some of the examples are below.

If you look at Image 1, it has a lot of selling wicks and buying

wicks, which are not suitable for this type of trading. It can trigger

your buy order or stop-loss order and can move in the opposite

direction. It’s better to avoid such scripts.

Another example is shown in image 2. It has too many gap

scenarios which are not suitable for this type of trading. It’s better to

avoid such scripts.

If you look at Image 3, it has too many gaps and no activity on

many trading days. It clearly shows that some operators are

controlling this stock. It’s better to avoid such scripts.

I don’t want to fill this book with too many such useless charts. I

hope this information is clear. If you get confused when you see a

chart, you can always move on to other scripts as there is no rule to

trade in that particular script itself.

What is Trend Line?

A Trend Line is a straight line drawn on a chart by connecting two

or more price peaks, which reveals the trend of the script, support

and resistance points, and allows to spot any excellent trade

opportunities.

A trend line speaks more than words do!

Below are some useful references to draw a trend line:

- Price Peaks

- The Slope of the Trend Line

- The price should respect the Trend Line

We need to consider 6 months to 1 year duration charts for this

system as our maximum holding period is just two weeks. We do not

need to know what happened beyond one year back as our holding

period is less. Besides, our stop-loss management process will take

care of any impact of the crucial price points, which occurred before

one year back.

Price Peaks

You should connect a minimum of 2 peaks to consider it as a valid

trend line.

Above is the example of a trend line that connected 3 peaks.

It can also be called as a Support Trend line.

Image 5 shows another example of a trend line that connected 4

peaks.

It can also be considered as a Resistance Trend Line.

A trend line can be considered as a powerful trend line when it

connects more number of peaks.

The Trend Line drawn in Image 6 is potent as it connects 8

peaks.

We should note that when a price shows a decisive break of the

trend line, it will give a quick and big move on the opposite side.

The Slope of the Trend Line

- Ideally, the trend line that shows less to the medium slope (less than 45 degrees) is the safer bet, Because this is the sign of a healthy trend.

- As the slope of a trend line increases, the validity of the support or resistance level decreases.

- A steep trend line results from a sharp advance (or decline) over a brief period.

- The trend line created from such quick moves is unlikely to offer a strong support or resistance level.

- Even if the trend line is connected with 3 or more valid points, attempting to take a trade is not a good idea.

Image 7 shows an example of a steep trend line.

It is not a healthy sign of a trend, and most probably, this script is

the victim of operators.

The Price Should Respect Trend Line

Whenever you draw a trend line, ensure price respects the trend

line with all its peaks.

Also Read:- HOW TO MAKE MONEY WITH BREAKOUT TRADING

Image 8 shows a trend line that is respected by all the peaks of

the price. Hence, this is a powerful trend line.

- Image 9 shows a trend line that is not respected by all the peaks of the price. Hence, this is a not powerful trend line.

- Always remember, drawing a trend line is subjective and art. Don’t get into arguments or discussions with anyone over any trend line.

- Remember the guidelines mentioned earlier whenever you try to draw a trend line. In this post, I am willing to provide more emphasis only on the resistance trend line as this post is for retail traders who start with small capital. Due to their low capital, they can afford to take their breakout trades only in equities. Because taking trades in futures requires significant capital as per money management rules (which I am going to explain later). Hence, they will not be able to opt for short trades.

- I will show some of the charts below, only to indicate how I prefer to draw the trend lines considering the rules mentioned above.

|

| Image 10 – A Breakout Example-1 |

|

| Image 11 – A Breakout Example-2 |

|

| Image 12 – A Breakout Example-3 |

|

| Image 2.13 – A Breakout Example-4 |

|

| Image 2.14 – A Breakout Example-5 |

By this time, you should have got some clarity on what kind of

scripts you are looking for and how to draw solid trend lines.

Canclusions

- We look at only daily charts with 6 months to 1 year duration to draw a trend line.

- We don’t consider charts that don’t have smooth price action.

- When a trend line connects more peaks, it will become a dominant trend line, and the break of such a trend line gives big moves.

- The slope of the trend line should be less than 45 degrees.

- The price should respect the trend line at all peak points.

- Drawing the trend line is an art, and it’s subjective. So, there is no need to debate with anyone.

I Hope you like Mahakal Trading Post "How to Draw a Trend Line for stock Trading" Thanks!

This is very nice post. Keep it up.

ReplyDeleteDLF share price