13 unique trade plan for Intraday Trading

Welcome to Mahakal Trading if you intend to win a game, then you should know all the rules of

the game in advance. Then only you can plan and show your talent in

the live game.

If you want any type of Trading Indicater free then you can cantact me with Telegram and Whatsapp

In the Traders’ perspective, this is called a trade plan. Plenty of successful traders give the allmost significance to the TRADE PLAN. As a trader before entering any trade, you should know the bare minimum below five aspects.

If you look at Image 7, we have a clear all-time-high breakout

trade.

If you want any type of Trading Indicater free then you can cantact me with Telegram and Whatsapp

In the Traders’ perspective, this is called a trade plan. Plenty of successful traders give the allmost significance to the TRADE PLAN. As a trader before entering any trade, you should know the bare minimum below five aspects.

- Based on your system, where is your entry point?

- In case your analysis goes wrong or trade setup fails, where is your stop-loss?

- Where is your anticipated exit based on your system to book the profits?

- What is the amount you are risking in this particular trade?

- How much amount do you risk on this trade out of your entire portfolio?

Trading Entry- Stop Loss- Target

|

| Image 1 – Entry-Stop Loss-Target Criteria in Breakout Trading System during Down Trend |

As shown in Image 1, Entry should come just a few ticks above

the high of the breakout candle.

Stop-loss will be a few ticks below the low of the breakout candle.

This script is showing a breakout from a downtrend. So, one

can aim at the beginning of the trend line or topmost swing as

the target.

Only opt to take the trade if it shows a minimum of 1:2 RiskReward. Otherwise, you need to ignore the setup and look for better

trade setups.

Note: Entry should come only above the high of the breakoutcandle. Never buy below the high of the breakout candle. Also, avoid

the trade if it opens above 2% from the previous day high as it

increases the stop-loss points and also it might attract profit booking.

Don’t buy even if it opens above 2% and comes back to the previous

day high because it’s against to breakout concept.

|

| Image 2 – Entry-Stop loss-Target Criteria in Breakout Trading System during Sideways Trend |

As shown in image 2, Entry should come just a few ticks above

the high of the breakout candle.

Stop-loss will be a few ticks below the low of the breakout candle.

This script shows a breakout from a sideways trend. So, one

can aim for the same width of the sideways trend as the target.

Only opt to take the trade if it shows a minimum of 1:2 RiskReward. Otherwise, you need to ignore the setup and look for better

trade setups.

|

| Image 3 – Entry-Stop Loss-Target Criteria in Breakout Trading System During AllTime-High |

Image 3 shows a breakout of all-time highs in a script. In this

case, it’s tough to come up with a fixed target as we don’t have any

reference points on the upside.

One can plan to book profits at 1:2 Risk-Reward, or trail stop-loss

below every swing low (you never know how far it will go!).

Besides, one can also plan partial exit at 1:2 Risk-Reward, and

manage the remaining position with trail SL concept.

The Untold Story About Trail SL

It is the most crucial aspect of this trading system. This

concept is also missing in most of the trading systems. Read this

section a few times, until it gets into your subconscious mind.

|

| Image 4 – A Breakout Trade Example-1 |

If you look at image 4, we have a clear breakout trade.

- Breakout Candle is big ✔ ✔

- Quick time ✔ ✔

- Absence of Selling wick ✔ ✔

- Good Volume ✔ ✔

It satisfies all our checklists. Hence, we will place a buy order

tomorrow above the high of the breakout candle. If triggered, the

stop-loss will be below the low of the breakout candle.

|

| Image 5 – Trail SL in case of a Small Candle after Breakout Example-1 |

The next day, it triggered our buy order (as price traded above the

high of the breakout candle).

However, it failed to give a big move on the upside.

Remember, our criteria for a breakout is the price should give

a big move in quick time with the absence of selling.

{Breakout rule applies for the next 2-3 trading sessions after the

breakout (as smart money will act either through selling or more

buying or doing nothing).

If they ‘Buy’ – the price will go up.

If they ‘Don't react' – the price will go up, or it will stay there (but

selling will not come).

If they 'Sell' – the price will show selling/fall.}

But in the above case, we can see an evident selling on the

next day after the breakout.

Hence, it doesn't make any sense to retain the original stoploss. It is better to trail below the low of the current day candle,

as shown in Image 5.

|

| Image 6 – Result in case of a Small Candle after Breakout Example-1 |

This action of trail SL resulted in a breakeven trade (maybe a

few points loss). But it saved 90% of the initial risk amount.

Note: Sometimes, price will hit your trail SL and then reach your

target. One should not change the trail SL concept just because of

this. The idea of this system is to reduce the initial risk as much as

possible if the price shows any danger and to ride the profits with

clear breakout scripts.

|

| Image 7 – A Breakout Trade Example-2 |

- Breakout Candle is big ✔ ✔

- Quick time ✔ ✔

- Absence of Selling wick ✔ ✔

- Good Volume ✔ ✔

It satisfies all our checklists. Hence, we will place a buy order

tomorrow above the high of the breakout candle. If triggered, the

stop-loss will be below the low of the breakout candle.

|

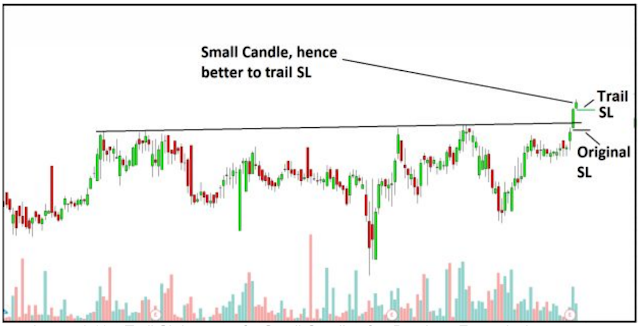

| Image 8 – Trail SL in case of a Small Candle after Breakout Example-2 |

The next day, it triggered our buy order (as price traded above the

high of the breakout candle).

However, it failed to give a big move on the upside and

resulted in a Doji candle.

Remember, our criteria for a breakout is that the price should

give a big move in quick time with the absence of selling.

Hence, it doesn't make any sense to retain the original stoploss. It is better to trail below the low of the current day candle,

as shown in Image 8.

|

| Image 9 – Result in case of a Small Candle after Breakout Example-2 |

However, this time price didn't hit the trail SL and went upside.

In the worst scenario, the smart money will show their reaction

within 2-3 days after the breakout. In this way we reduce the initial

risk!

Now we will look at one more example.

|

| Image 10 – A Breakout Trade Example-2 |

If you look at Image 10, we have a clear all-time-high breakout

trade.

- Breakout Candle is big ✔ ✔

- Quick time ✔ ✔

- Absence of Selling wick ✔ ✔

- Good Volume ✔ ✔

It satisfies all our checklists. Hence, we will place a buy order

tomorrow above the high of the breakout candle. If triggered, the

stop-loss will be below the low of the breakout candle.

|

| Image 11 – Trail SL in case of a Small Candle after Breakout Example-3 |

The next day, it triggered our buy order (as price traded above the

high of the breakout candle).

However, it moved only a little bit on the upside and resulted

in a small candle.

Remember, our criteria for a breakout is that the price should

give a big move in quick time with the absence of selling.

Hence, it doesn't make any sense to retain the original stoploss. It is better to trail below the low of the current day candle,

as shown in the Image 11.

|

| Image 12 – Result in case of a Small Candle after Breakout Example-3 |

This time also price didn't hit the trail SL and went upside

immediately.

Note: I can give many examples of this concept. However, I feel

these three scenarios are enough to convey what I am trying to

say!

After showing a breakout, rarely does price witness

significant selling. In most cases, it will rally on the upside

immediately or go to sideways mode and then rally on the

upside or will slow down, and then it will fall.

I am trying to minimize our losses by 75-90% if it fails to give

a big move on the upside.

How to Take Your Exit To the Next Level

I repeat once again. Only 'Entry' and 'Exit' decide the fate of your

trade irrespective of your reputation, experience, and qualification!

I have noticed that many traders learn quickly about 'Entry’. But

when it comes to 'Exit,' they struggle a lot. Because every time 'Exit'

will tell you whether you made profit or loss.

In both cases, it triggers many emotions. So, one should have a

proper plan towards 'Exit’.

I suggest below two steps to manage your 'Exit':

Step-1: As per the plan (Images 1, 2, and 3 for a downtrend,

sideways, and all-time-high, respectively), exit 100% of the position at

the target level.

Follow the below steps for a few months until you can manage

your existing trades. This method involves many activities:

- Search breakout scripts every day.

- Shortlist only 2-3 scripts for the next day. Don't try to keep more than 3 scripts on any trading day.

- The next day, when the market opens, place an SL-M buy order above the high of the breakout candle for all the scripts.

- If it opens with a small gap (less than 2%), then you can buy at market order.

- If you bought, keep a stop-loss order below the low of the breakout candle.

- Again, after market hours search for breakout scripts.

- The next day, once the market opens, keep stop-loss for your existing positions.

- Then you can place an SL-M buy order for any new scripts.

- If you get a small candle or a selling candle after the breakout, trail your SL from the low of the breakout candle to the low of the next day candle (Images 4 to 12)

- When the price reaches your target, either exit manually, or you can place Limit Sell order to close the position at the target level.

- Maintain a trading journal. Write all your trades here. Analyze the failed trades.

- Repeat the entire process.

Step-2: Only after you are familiar with the process mentioned

above can you plan to implement this step. It contains all the

procedures which are mentioned in Step-1.

The only new thing is, instead of exiting 100% position at target,

exit only 75% of the position at target. Carry the remaining 25% with

a trail stop-loss below the low of the target day candle or below any

swing low.

Many times, these breakout scripts run like crazy, and 25% of

the position, in one such trade has the potential to absorb the

loss of your 25 trades!

|

| Image 13 – Partial Exit (Example-1) |

The above image explains everything about the power of partial

exit. You will have made an excellent profit if you keep using the trail

SL concept below the low of every swing.

|

| Image 14 – Partial Exit (Example-2) |

The Image 14 explains the same story of partial exit. It would

have given 8-10 times the returns of your original risk for your 25%

position.

|

| Image 15 – Partial Exit (Example-3) |

The Image 15 explains another story of partial exit. It would

have given 10-12 times the returns of your original risk for your 25%

position.

I hope that after seeing these examples you have understood the

power of partial exit.

How I Stopped Losing Money in Trading

I am going to reveal shocking news to all of you now.

Whatever you have learned till now is part of only 10% of

successful trading!

Are you shocked to hear this?

Well, that's a solid fact!

Because anybody can come with a trading system that has fair

efficiency and good risk-reward; in fact, you get so many trading

systems if you google it.

However, risk management or money management is the

primary key to successful trading.

It raises two critical questions:

1. How much to deploy/risk per trade?

2. How much % of the capital to deploy in trades at any

point of time?

How much to deploy/risk per trade?

I suggest a simple technique for this. For one trade, use only 10%

of your capital irrespective of the risk.

For example, if you have Rs.1,00,000 as your capital and if you

finalize a script ABC, assume your entry price is Rs. 100.

Then 10% of your capital is Rs.10,000. So, you can buy

10,000/100 = 100 Shares.

Using this approach, your entire capital percentage risk per trade

varies between 0.5% - 2% (based on how deep your stop-loss is),

which is fine.

Some people suggest to risk only 1-2% of your capital per trade,

and they don't put an upper cap on the capital. It brings some

confusion, and you will not be able to opt for more trades.

Let me explain with one example.

Assume your capital is Rs.1,00,000.

You are planning to risk 2% of your capital per trade, which is Rs.

2000/trade

You had shortlisted a script XYZ – Entry at 1000 and SL at 990.

Then the total number of shared to buy = Rs. 2000/10 = 200

shares.

The capital required to buy 200 shares = 200 X Rs. 1000 = Rs.

2,00,000

But you don't have Rs. 2,00,000 capital in your account, do you?

So, the simple way is to deploy only 10% of your capital on

one trade!

How much percentage of the total capital should be deployed in trades at any point in time?

It is a million-dollar question!

I feel no one can answer this question with 100% accuracy or like

a formula.

It is effortless to answer, “Deploy 100% of the capital in Uptrend,

only 50% in a sideways trend, and sit with cash in a downtrend.”

However, implementing this is a real practical problem.

I have a simple suggestion for new traders.

Never deploy more than 50% of your capital on trades until you

experience all market trends (like uptrend, sideways, downtrend, and

random).

In other words, you are not supposed to carry more than 5 trades

on any given market conditions (except for the remaining 25% of the

position on winning trades as you have already made a profit with

these trades for 75% position).

Once you cross this stage, automatically, you get the knowledge

to increase or decrease your allocated capital based on the market

conditions.

Why Even Smart People Fall for Market Conditions

When I was working in the software industry, I had a teammate.

His name is Vinod and he was

excellent in whatever he did. He was smart and would come up with

brilliant ideas, and in fact, he was the one who introduced me to the

stock market a decade back.

He was quite an achiever, be it a career or with personal ventures

beyond the office. When he jumped into trading, he had a robust

system with proper risk management. However, he still failed in

trading!

I have spent a couple of years wondering why he failed in trading,

admitting the fact that his failure generated fear in my mind those

days. Perhaps when an intelligent person like vinod fails in trading, I

thought I could never win this game!

However, after several years of analysis, I realized the rationale

behind his failure, which I will be presenting as awareness in this

session.

|

| Image 16 – 4-Stages of the Market |

As shown in Image 16, the market has four trends.

Every trading system layout has different results in these four

stages.

A trader has to go through all these market conditions with a

particular trading system. An excellent trading system can reward

better outcomes within 2-3 market stages, as mentioned above.

So, even if a trader uses such an excellent trading system, he

should know how to handle the system when the market stage is not

in the system's favor. He should learn how to avoid trades (or how to

reduce the risk) in such market stages. Otherwise, his learning curve

will not become complete.

For example, if you have a trending system, it works well with

Uptrend and Down Trend. It doesn't give more trades and results in a

sideways trend and random market conditions.

Vinod had made a similar mistake. He picked up one trading

system first with a lot of studies and backtesting. It worked fine for

some time. It was not generating more trades when the market

conditions changed.

Instead of sticking to the same trading system, Vinod identified

another trading system. It worked for some time, and later the same

story continued. Finally, he gave up!

Now, tell me, do you want to make the same mistake?

I hope not!

Then I am stating in advance that to taste success with the

Breakout System, you need to stick to the process with the abovementioned four stages of the market.

How much time do you need to face all the four stages of the

market?

My answer is I don't know!

Because the market is not in my control, sometimes, it has shown

all these different conditions within one year, and sometimes, it took

3-4 years.

So, approximately we can aim for 2 years to get some success

with this Breakout Trading system.

But, I can give the below features of the breakout system (keeping

only 'Long' trades).

In Uptrend, you get many scripts every day, and you will get good

results.

In Sideways trend, you get a decent number of trades, and you

will also get good results.

In Down Trend, you don't get more number of trades. Besides,

more number of trades get out of the trade at breakeven (recall my

trail SL plan in case of a small or selling candle after breakout).

In Random market conditions, the result is not guaranteed. On

some days, you don't get any trades. Sometimes, the price hits your

target on the same day. In some cases, you take stop-loss.

We should be RIGID about our RULES and FLEXIBLE about our

EXPECTATIONS from the market.

BUT the problem is we are RIGID about our EXPECTATIONS but

FLEXIBLE about our RULES.

Please keep this in mind.

Summary

- Having a trade plan is essential to track all your trades and to get success in trading

- In this system, Entry should come above the high of the breakout candle.

- In this system, Stop-loss will be below the low of the breakout candle.

- In a downtrend, one can target the beginning point of the trend line as the target, in sideways the same width of the trend as target and in an uptrend with trail stop-loss.

- You should trail your SL when there is a small candle or selling candle immediately after the breakout day.

- After some practice, you can plan to exit only 75% position at target and carry the remaining 25% with the target candle low as the stop-loss

- Allocate only 10% of your capital per trade.

- If you are a beginner, don't deploy more than 50% of your capital at any point of time.

- To taste success, one should follow this system across all the four stages of the market.

I Hope You Like Mahakal Trading Post " 13 unique trade plan for Intraday Trading" Thanks!

No comments